Blog 12

Made out of Africa

By Degol Hailu, Senior Advisor

Chinpihoi Kipgen, Research Associate, UNDP

July 2016

There is a “Made in Africa” movement in the continent. It espouses growth in the manufacturing sector as the major driver of development. How is this movement doing so far?

We examined fifteen countries that experienced annual real GDP growth rates averaging 7% or higher over the past decade. For sure, the high growth was not limited to natural resource extraction and export. For instance, Burkina Faso, Ethiopia and Rwanda, all without significant natural resource sectors, were among the highest growing economies.

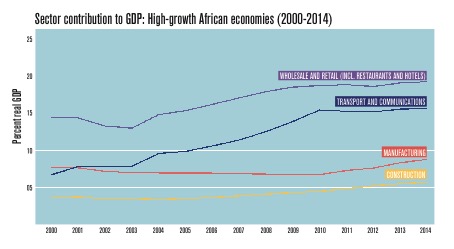

The sectors that experienced the highest growth are wholesale and retail trade; transport and communications; and construction. Each of them grew at an average annual rate of 11% or higher. In 2010, these by and large service-oriented sectors contributed 1.4%, 2.1% and 0.5% to the growth in real GDP, respectively.

The manufacturing sector grew at an average annual rate of 9%, but its importance is not impressive, representing less than 9% of GDP over the past decade. In fact, of the fifteen high growth economies, eight experienced a contraction in their manufacturing sectors. The manufacturing sector contributed about 0.4% to GDP growth in the high growth years.

Although technological progress has made services more tradable, the sector still largely requires consumers and producers to be in the same location. The disproportionate growth in the non-tradable service sector, therefore, runs contrary to the “made in Africa” ambitions. The manufacturing sector was believed to substitute imports as well as generate foreign exchange through exports.

Economists have always argued services and manufacturing are complementary sectors. Manufactured goods need to be transported, wholesaled and retailed, with communication supporting logistics and distribution. For example, UNCTAD’s recent Economic Development in Africa report noted that the share of services in real output was highest among exporters of manufactured goods. Moreover, several countries are becoming regional service hubs, for instance, air transport in Ethiopia and South Africa and the financial and banking industries of Mauritius and Nigeria.

If manufacturing growth is not that impressive, then what is the bulk of the service sector servicing? The answer is, imports. In 2010, the value of imported consumer goods in several high growth countries was 1.6 times that of exports. By 2014, the figure increased to 4.6. High level of imports, coupled with the low value added contribution of manufacturing, implies that the highest growing sectors in Africa (e.g. wholesale and retail) are funneling manufactured goods – just not those that are made in Africa, but outside of it.

Despite the complementarity between the sectors and slight acceleration in manufacturing growth in recent years (see chart), the correlation between the service and the manufacturing sectors for the fifteen countries we examined was negative. This result substantiates the point further.

A shift towards a stand-alone service sector, without a corresponding growth in manufacturing productive capabilities, therefore, makes the sustainability of growth questionable. The “Made in Africa” movement recognizes these challenges. Only that progress is snail-paced.